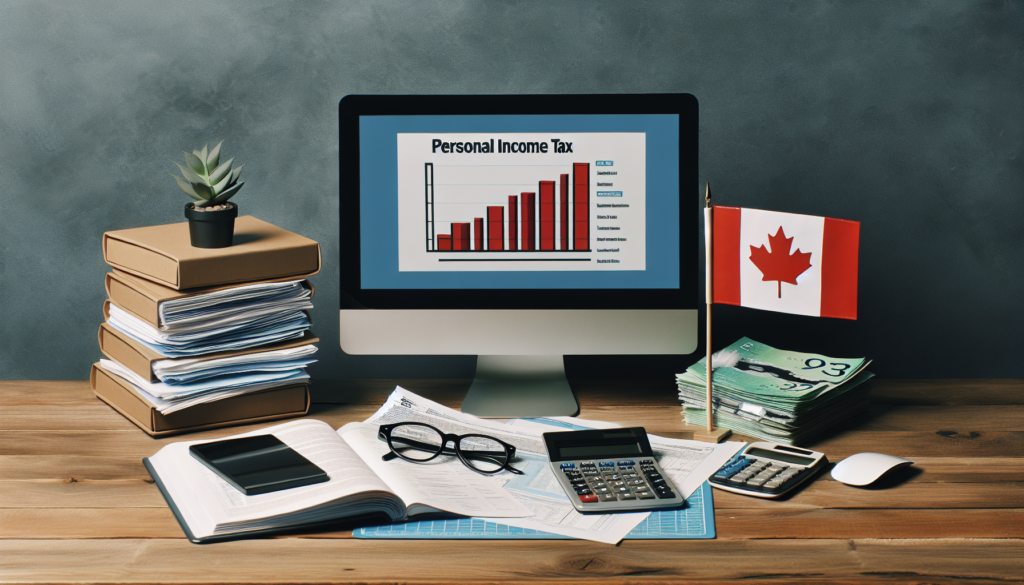

In 2024, Canadian taxpayers, especially in Edmonton, will face significant tax changes requiring strategic planning and expert guidance. The Edmonton Personal Income Tax Accountants at BOMCAS are vital in this landscape, offering advice beyond annual filings. Key changes include:

Income-based Taxes: Increase to support social safety nets.

CPP Enhancements: Introduction of CPP2 and higher pensionable earnings, reaching up to $73,200 in 2024 and $79,400 in 2025.

Employment Insurance: Higher premium rates and maximum insurable earnings.

Carbon Tax: Rise from $65 to $80 per tonne, affecting many sectors.

Excise Taxes on Alcohol: Increase, possibly affecting prices.

Digital Services Tax: Targeting large online companies for fairer digital economy taxation. Provincial adjustments vary, with British Columbia raising the carbon tax, Manitoba revising tax brackets, Ontario extending gas tax cuts, Quebec reducing income tax rates, Saskatchewan doubling the small business tax rate, and Atlantic Provinces altering home heating carbon tax and income tax structures. BOMCAS accountants are equipped to navigate these changes, ensuring clients fulfill tax obligations while optimizing financial outcomes.